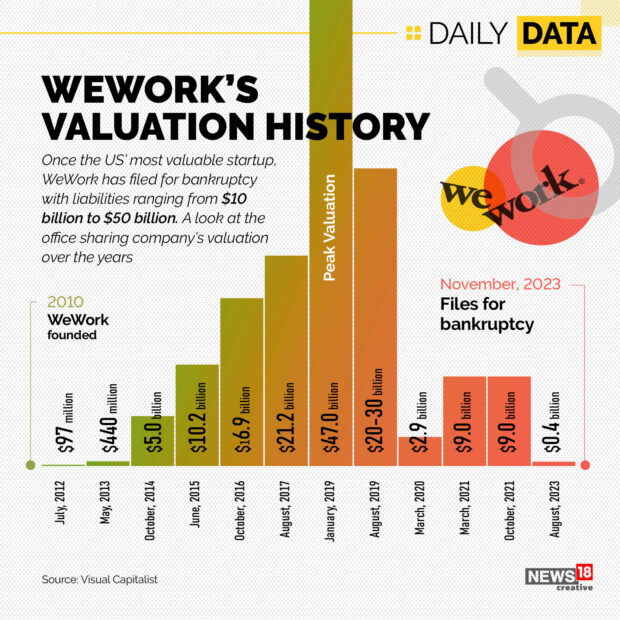

WeWork, the once soaring giant of the coworking industry, is now facing Chapter 11 bankruptcy protection. Once boosting an incredible $47 billion valuation, the company has now fallen into bankruptcy’s unforgiving arms. But how did this titan of shared office spaces go from the talk of the town to talking about Chapter 11? Let’s unfold what exactly happened with the WeWork bankruptcy.

The Factors That Led To The WeWork Bankruptcy Filing

At its peak, WeWork and its founder CEO, Adam Neumann, were the emblem of startup success. It was more than an office space provider; it was a visionary’s playground. Then, the dream soured. The economic landscape shifted, remote work became the new norm during COVID, and WeWork’s financial scaffolding crumbled.

WeWork’s downfall from a $47 billion valuation to bankruptcy shows how crucial it is for businesses to be financially sustainable and adaptable. WeWork’s downfall can be attributed to a combination of the following factors:

COVID Pandemic Impact

The COVID-19 pandemic disrupted the traditional office workspace model. As more people started working from home, there was a dramatic reduction on the demand for shared office spaces, which was WeWork’s primary business.

Financial Struggles

WeWork had a massive debt load, and the pandemic exacerbated its financial difficulties. As COVID lockdowns extended into multiple years, the company faced increased challenges in servicing its debt obligations.

Leadership Issues

WeWork had a history of leadership problems, with co-founder and former CEO Adam Neumann being ousted in 2019 due to concerns about his management style and corporate governance issues.

Failed IPO Attempt

WeWork’s attempt to go public in 2019 was marred by revelations of significant losses and corporate governance concerns, causing the company to withdraw its IPO plans. This significantly eroded investor confidence. The company wouldn’t go public until October 21, 2020… during COVID.

Changing Market Dynamics

WeWork’s business model was closely tied to commercial real estate and the concept of communal office spaces, which was disrupted by the rise of remote work and flexible office solutions.

Increased Competition

WeWork faced stiff competition from other coworking providers and flexible workspace solutions, further impacting its ability to maintain market share and profitability.

Financial Mismanagement

The company’s financial troubles were compounded by allegations of financial mismanagement and lavish spending on the part of its executives.

SoftBank Watches Their WeWork Investment Wither Away

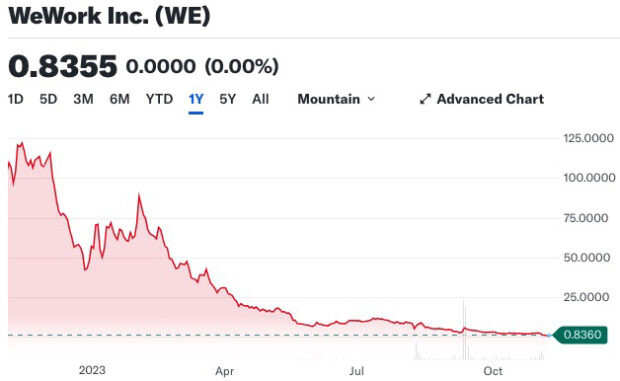

SoftBank, with its 71% stake in WeWork, saw its shiny $47 billion valuation diminish to mere millions. In 2023 alone, WeWork stock has nosedived 98%. In November 2022, WeWork stock was at $130. A year later, it has sunk to just $0.83.

It’s not just numbers; it’s a narrative of ambition, miscalculation, and the relentless pursuit of a turnaround. SoftBank, WeWork’s once confident Japanese tech investor, now concedes that WeWork’s future hinges on renegotiating leases and wiping out substantial debts.

What’s Next For WeWork?

The WeWork bankruptcy serves as a cautionary tale about the challenges of maintaining a high valuation and growth trajectory in the fast-paced tech and startup world, especially in an industry as susceptible to market shifts as commercial real estate.

But WeWork isn’t waving a white flag just yet. According to the company, bankruptcy protection is a restructuring effort, not a retreat.

WeWork’s Chapter 11 bankruptcy filing is an attempt to restructure its debts and leases while remaining operational. The fact that 92% of the company’s secured debt investors have agreed to adjust the terms of their loans is a positive sign for WeWork’s efforts to continue its operations and stabilize its finances.

With eyes on the future, we’re reminded that even in downfall, there’s a blueprint for rebirth. How long WeWork will be able to stay in business remains to be seen.

WeWork Bankruptcy: The Factors That Caused A $47 Billion Startup Juggernaut To Fall On Bankruptcy's Doorstep … #WeWork #Bankruptcy #WeWorkBankruptcy #AdamNeumann Share on XI’m a dog owner that loves poetry, vampires, mountain biking, and cosplay. I’m open to ideas and still trying to figure my SFO life out one blog post at a time. LF ISO SWF GSOH SI DDF.

OpenAI Announces New AI App Store For Creators To Sell GPTs

OpenAI Announces New AI App Store For Creators To Sell GPTs

Leave a Reply

You must be logged in to post a comment.