Need some extra beer money? Well, you might be in luck! According to the National Association of Unclaimed Property Administrators (NAUPA), 1 in 10 Americans have unclaimed money or property waiting to be found. That’s right – billions of dollars are sitting in state treasuries and other government agencies, waiting to be claimed by their rightful owners.

Table of Contents[Hide][Show]

- What is Unclaimed Money?

- Step 1: Start Your Unclaimed Assets Search with State Databases

- Step 2: Use MissingMoney.com for Multi-State Searches

- Step 3: Check Federal Databases

- Step 4: Search for Specific Types of Unclaimed Money

- Step 5: Claim Your Missing Money

- Tips to Prevent Future Unclaimed Property

- Beware of Unclaimed Money Scams

- Lost and Found:How To Find Unclaimed Money

- Frequently Asked Questions

In this guide on how to find unclaimed money, we’ll walk you through the process of finding and claiming your lost or forgotten money. Whether it’s an old bank account, uncashed paycheck, or forgotten utility deposit, we’ll show you how to track it down and get it back where it belongs – in your pocket.

What is Unclaimed Money?

Before we jump into the unclaimed money search process, let’s clarify what we mean by “unclaimed money.” Unclaimed property consists of financial assets that have been inactive for a certain period, typically one year or more. This can include:

- Checking or savings accounts

- Uncashed payroll checks

- Stock dividends

- Insurance payments

- Unredeemed gift cards (According to this CBS News report, $3 billion in gift cards go unused every year.)

- Utility deposits or overpayments

- Tax refunds

- And much more…

When these assets go unclaimed, companies are required by law to turn them over to the state for safekeeping. The state then holds onto this property until the rightful owner (or their heir) comes forward to claim it.

WARNING: Never pay a third party to help you find or recover unclaimed money from either the Federal or State government. Only use official government websites to find and claim your unclaimed assets. The government websites are free! If you are paying someone to help you recover unclaimed money, then it’s probably a scam.

Step 1: Start Your Unclaimed Assets Search with State Databases

The first and most crucial step in finding your unclaimed money is to search state databases. Here’s how to do it:

- Visit the National Association of Unclaimed Property Administrators (NAUPA) website at Unclaimed.org.

- Use the interactive map to find links to each state’s official unclaimed property program.

- Search in every state where you’ve lived or done business.

PRO-TIP: Use both your current and maiden name (if applicable) when searching. Try different search queries, such as using the first initial of your first name plus your full last name.

After just a few minutes of searching, you should be able to find a few examples of unclaimed assets that either you or your family members have in different states.

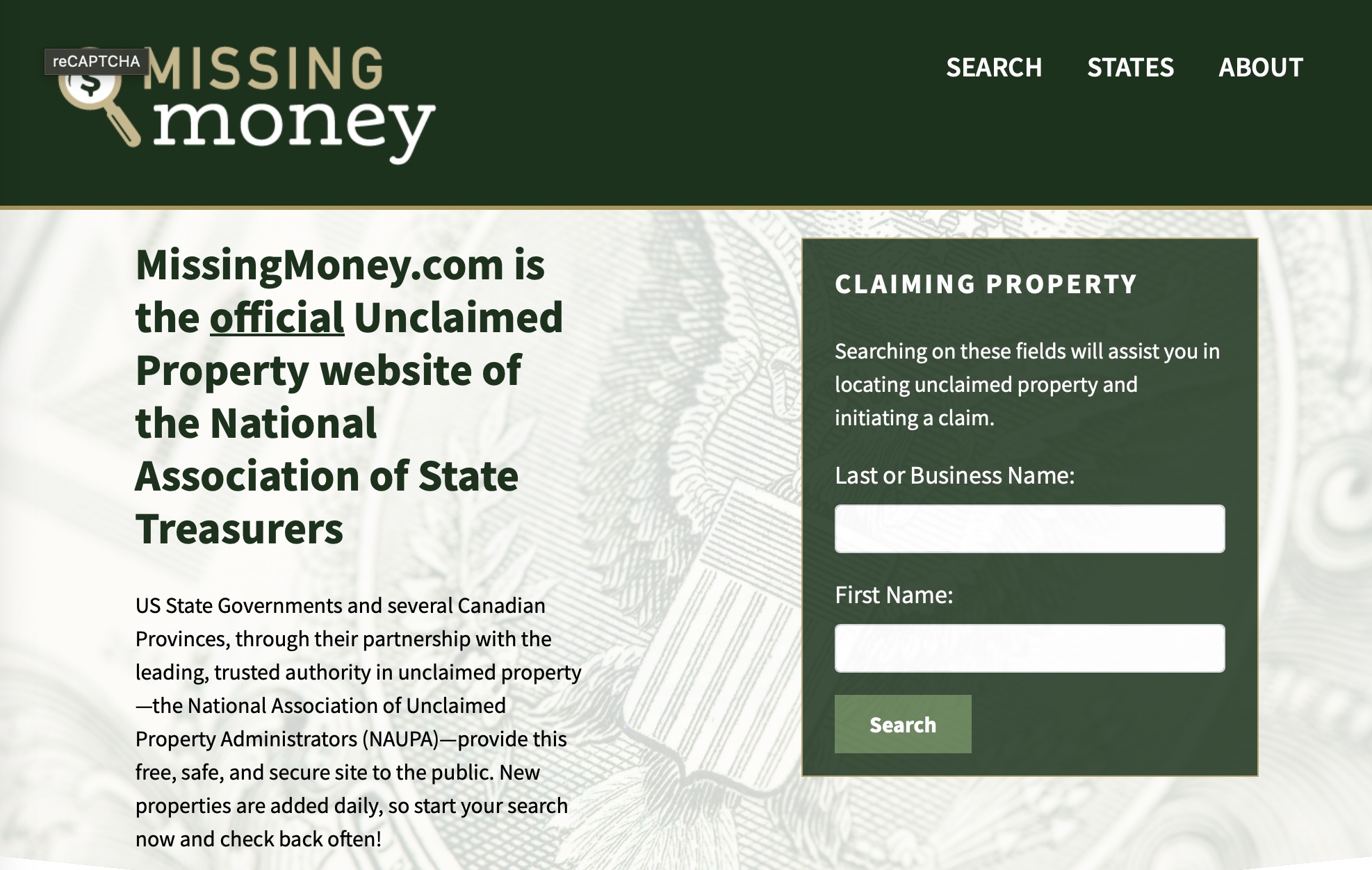

Step 2: Use MissingMoney.com for Multi-State Searches

To streamline your search across multiple states, use MissingMoney.com, a free Government website endorsed by NAUPA. This platform allows you to search several states simultaneously, increasing your chances of finding unclaimed property quickly.

Step 3: Check Federal Databases

While most unclaimed money is held by states, some federal agencies also hold unclaimed funds. Here are some key resources to check:

- IRS.gov – For undelivered tax refunds

- PBGC.gov – For unclaimed pension money

- TreasuryHunt.gov – For unclaimed savings bonds

Step 4: Search for Specific Types of Unclaimed Money

Depending on your situation, you might want to check these specialized databases:

- Department of Labor’s database for unpaid wages

- U.S. Department of Veterans Affairs for unclaimed insurance funds for veterans

- HUD database for FHA insurance refunds

- Securities and Exchange Commission (SEC) database for money from investment enforcement cases

- FDIC and NCUA databases for unclaimed funds from closed banks and credit unions

Step 5: Claim Your Missing Money

Once you’ve found potential matches, it’s time to claim your missing money. Here’s what you need to know:

- File your claim directly through the state’s official website. Never pay a fee to claim your money – it’s always free.

- Be prepared to provide proof of ownership and identity. This may include:

- A copy of your driver’s license or passport

- Proof of address (utility bill, etc.)

- Social Security number

- Additional documentation depending on the type of claim

- Follow the state’s instructions carefully. Each state has its own process for verifying and processing claims.

- Be patient. Processing times can vary from a few weeks to several months.

Tips to Prevent Future Unclaimed Property

To avoid losing track of your money in the future, follow these tips:

- Keep your accounts active by making small transactions periodically.

- Update your contact information with financial institutions whenever you move.

- Cash all checks promptly, including dividend and insurance claim checks.

- Respond to requests for contact from financial institutions, even if no immediate action is required.

- Keep accurate records of all your financial accounts and transactions.

- Inform a trusted family member about your accounts in case something happens to you.

Beware of Unclaimed Money Scams

While searching for unclaimed money, be cautious of potential scams. Remember:

- Legitimate unclaimed property searches and claims are always free.

- Government agencies will never ask for upfront fees to claim your money.

- Be wary of unsolicited emails or calls about unclaimed money.

- Always verify the legitimacy of any website by ensuring it ends in “.gov” for government sites.

Lost and Found:How To Find Unclaimed Money

Finding unclaimed money can be like discovering a hidden treasure – and it’s easier than you might think. By following this guide and using the resources provided, you could potentially recover forgotten funds that rightfully belong to you. Remember to search thoroughly, claim responsibly, and stay vigilant against scams.

Don’t leave your money sitting in state treasuries or government agencies. Start your search today and reclaim what’s yours!

Frequently Asked Questions

- How much unclaimed money is out there? Billions of dollars in unclaimed property are currently held by state governments and treasuries within the United States.

- Is there a deadline for claiming unclaimed property? Most states do not have a deadline for claiming unclaimed property. However, it’s best to claim your property as soon as possible.

- Can I claim money on behalf of a deceased relative? Yes, you can claim unclaimed property for deceased relatives if you are their legal heir. Additional documentation may be required to prove your relationship and right to claim.

- How often should I check for unclaimed money? It’s a good idea to check for unclaimed money annually or whenever you move to a new state.

- What if I find unclaimed property in a state where I no longer live? You can still claim property from states where you previously lived or did business. Each state has its own process for out-of-state claims.

Remember, unclaimed money searches should always be free, easy, and secure. Start your search today and you might just find some extra cash you didn’t know you had! Cha-ching!

Did you know 1 in 10 Americans have unclaimed money? Learn how to find your lost cash for free! Check out our step-by-step guide on how to find unclaimed money. #UnclaimedMoney #FinancialTips Share on X

What is the most famous line in A Few Good Men?

What is the most famous line in A Few Good Men?

Leave a Reply

You must be logged in to post a comment.